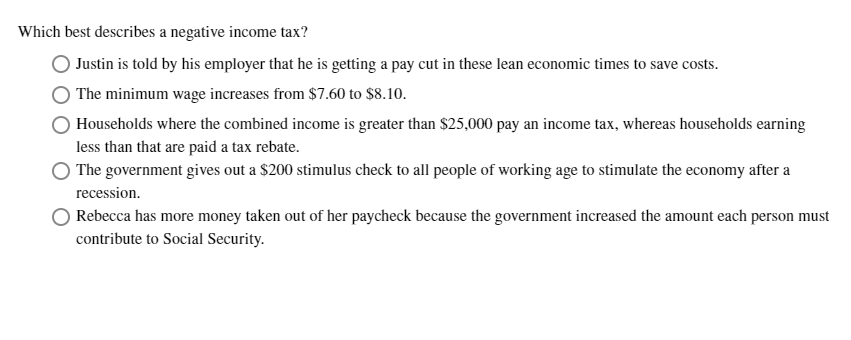

Hich Best Describes a Negative Income Tax

250 to the Internal Revenue Code and with it the FDII deduction which provides an incentive to domestic corporations in the form of a lower tax rate on income derived from tangible and intangible products and services in foreign markets. This conversation has been flagged as incorrect.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Which decreases the purchasing power of consumers.

. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable incomeIncome tax generally is computed as the product of a tax rate times the taxable income. 21 Describe the Income Statement Statement of Owners Equity Balance Sheet and Statement of Cash Flows and How They Interrelate. The Tax Court disagreed and held that a credit allowed as a result of an NOL carryback could be considered as a rebate under IRC 6211b2.

We can consider negative income tax as a mirror image of regular income tax where those individuals earning above the threshold pay tax to the government and those below receive refundable credits from the government. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. While both individuals could say theyre in the 25 bracket the one with the higher income has an effective tax rate of 18 90000 in tax divided by 500000 in.

The option that best describes income tax is direct tax A tax in the United States is the percentage the government takes form income or when you purchase something. The second column has entries 50000 negative 8950 41050 7090 negative 1500 and 5590. Sometimes the IRS makes adjustments to income on the tax return which are offset by other adjustments for the same taxable year.

23 Prepare an Income Statement Statement of Owners Equity. A guaranteed minimum income plan advocated by economist Milton Friedman in 1962 where federal income subsidies are provided to persons or families whose income falls. Tax systems competitiveness Congress added Sec.

B Corporations experience record growth. Value of the property. A 2-column table has 6 rows.

D The unemployment rate increases from 7 to 17. The first column has entries Income Deductions Taxable income taxes tax credit and taxes owed. OThe minimum wage increases from 760 to 810.

What is negative income tax. 22 Define Explain and Provide Examples of Current and Noncurrent Assets Current and Noncurrent Liabilities Equity Revenues and Expenses. An is a tax issued by the federal government on imported goods.

Negative Income Tax - NIT. Everyone who falls below the poverty line receives a state subsidy. Asked 12162015 104519 AM.

Which of these best describes income tax. Negative income tax is a system where cash is given by the government to eligible tax residents who are earning below a certain threshold. Updated 12172015 83437 AM.

Log in for more information. C The sales tax on food is raised by 001. Which of the following inequalities does Cohens socialist or radical principle of equality of opportunity address.

Check all that apply. Which best describes a negative income tax. Households where the combined income is greater than 25000 pay an income tax whereas households earning less than that are paid a tax rebate.

A negative net income means a company has a loss and not a profit over a given accounting period. Which phrase best describes the basis of seals taxes. Which explains a difference between income and taxable income.

Property taxes are usually determined based on. The United States. The chart shows taxable income.

Which of the following best describes a negative income tax. Inequalities in opportunity due to brute luck. Which of these best describes income tax.

There are federal taxes and state taxes that are collected to be invested in infrastructure to help citizens and communities and to pay the bureaucracy of the government. In the spirit of increasing the US. The one that describes a type of tax that funds city programs is.

Which terms best describe sales tax. An alternative minimum tax AMT places a floor on the percentage of taxes that a filer must pay to the government no matter how many deductions or credits the filer may claim. In contrast to a standard income tax where people pay money to the government people with low incomes would receive money back from the government.

O Justin is told by his employer that he is getting a pay cut in these lean economic times to save costs. A Insurance premiums do not change. Regressive tax progressive tax direct tax proportional tax.

Local income tax Fourteen states and Washington DC allowed their cities to create their own regulation regarding local income tax which they could use to funds several city programs such as park maintenance building public benches etc. See answer 1 Best Answer. Which of these would have the GREATEST negative impact on Individual Income Tax as a source of revenue.

The negative income tax is a way to provide people below a certain income level with money. While a company may have positive sales its expenses and other costs will have exceeded the.

Solved Which Best Describes A Negative Income Tax O Justin Chegg Com

Progressive Tax Definition Taxedu Tax Foundation

Sample 623 Letter Money Saving Plan Credit Counseling Reduce Debt

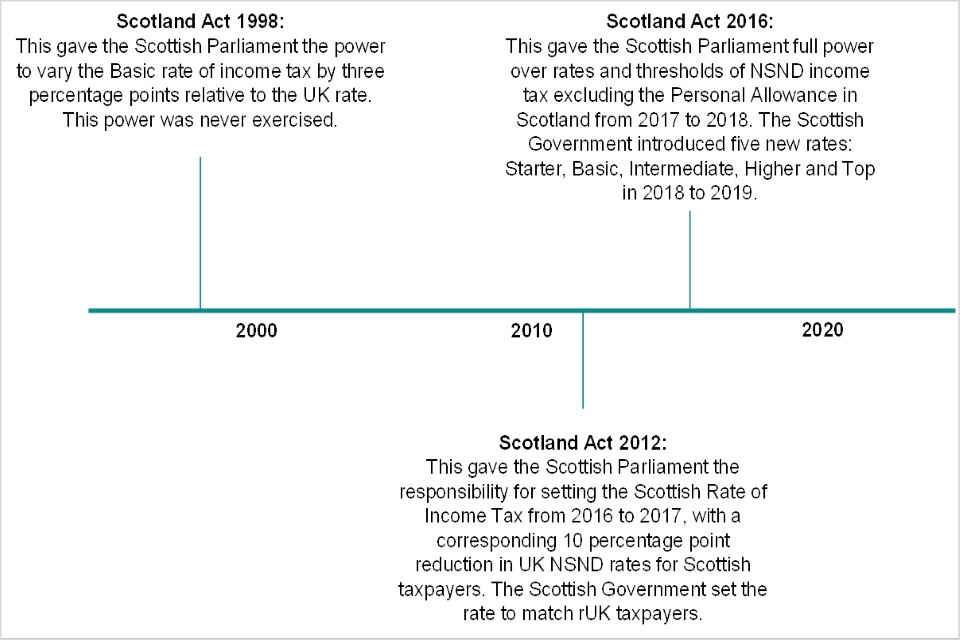

Estimating Scottish Taxpayer Behaviour In Response To Scottish Income Tax Changes Introduced In 2018 To 2019 Gov Uk

International Corporate Taxation What Reforms What Impact Cairn International Edition

How Is Tax Liability Calculated Common Tax Questions Answered

How Do Net Income And Operating Cash Flow Differ

Effects Of Income Tax Changes On Economic Growth

An Education You Can Take To The Bank Bliss Business Education Network Marketing Education College

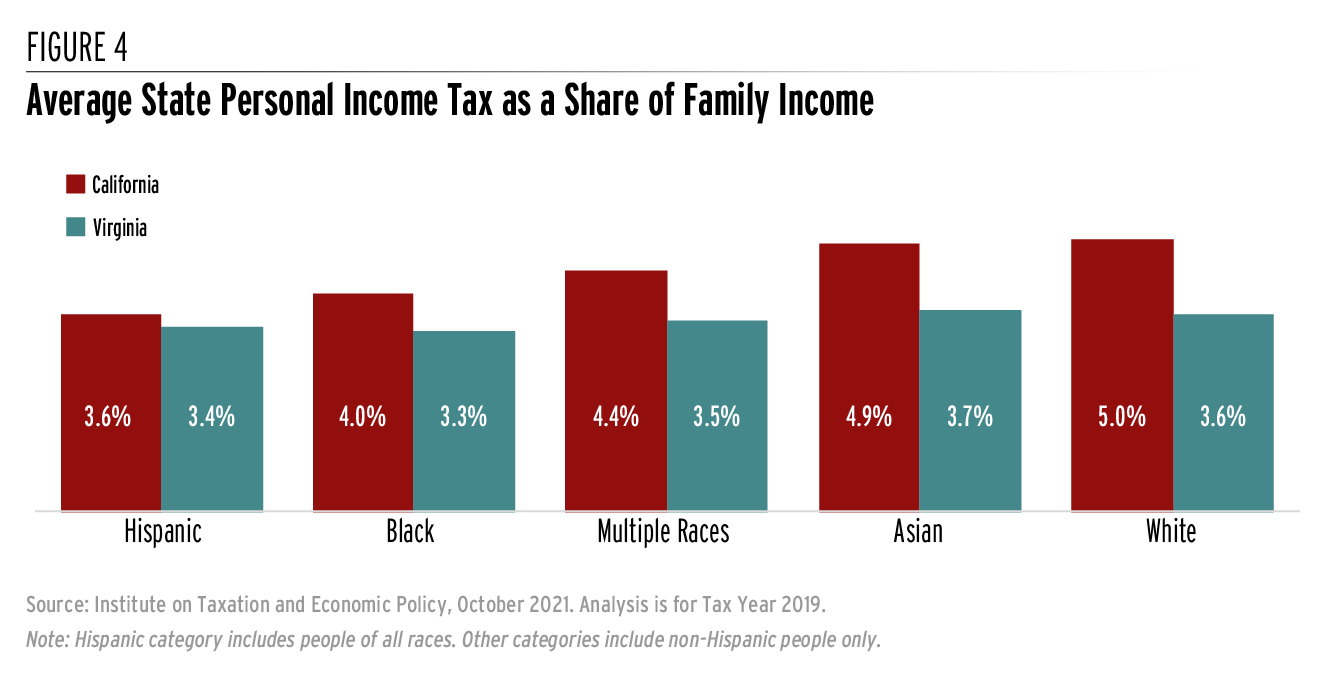

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Secret Plan Shows The Irs Wants To Get Out Of The Business Of Talking With Taxpayers Advocate Says How To Plan Tax Refund Internal Revenue Service

How Is Tax Liability Calculated Common Tax Questions Answered

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Better Way Financial Services Planning Advice Investing

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Solved Consider A Firm That Is A Monopsony When Hiring Chegg Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Comments

Post a Comment